by Laurie Pickard | Feb 23, 2014 | MOOC MBA Design

I’ve written a lot about why I think I a MOOC-based MBA is a good idea for me. I already have a master’s degree, I live in a place where B-school isn’t readily accessible, I already work in the field I want to be in, I am building my network through professional contacts in my field, etc. But I realize that I haven’t made the financial case for the No-Pay MBA. I would like to take this opportunity to fix that.

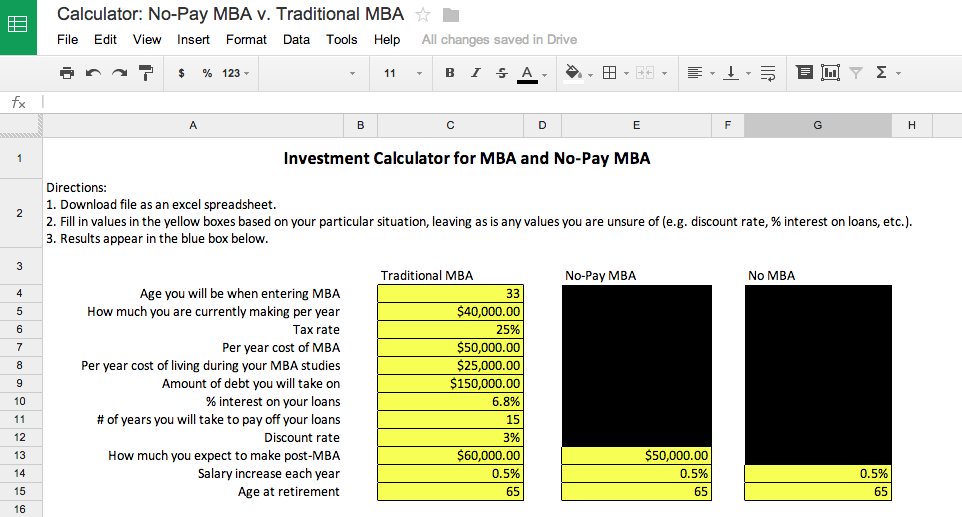

One of my themes this semester is finance, so it’s a good time to take a look at the financials for the No-Pay MBA. I have created a spreadsheet – what else do you do in finance? – to help me (and others) figure out how an investment in a No-Pay MBA stacks up next to an investment in a traditional MBA. I am making this spreadsheet available as a tool that anyone can use.

The spreadsheet can be found here: No-Pay MBA v. Traditional MBA Calculator

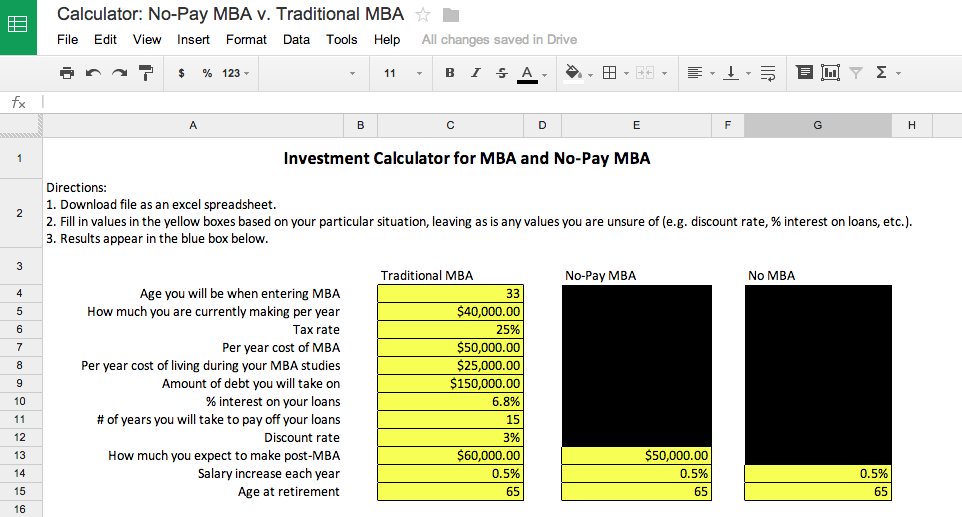

It looks like this:

For those who haven’t studied finance, let me explain how it works. In order to answer a question like “is an MBA a good investment?” you have to define the situation in which you will be investing in an MBA - are you a recent college grad with 30 years of work ahead of you, looking to go into a career in finance; or are you in your mid-thirties, working in non-profit administration, trying to get a leg up for your next position? These factors make a difference as to whether an MBA is a good choice for you or not. In the spreadsheet, the yellow boxes allow you to fill in details that reflect the particulars of your life and career situation. The spreadsheet has columns for three scenarios – traditional MBA, No-Pay MBA, and no MBA. I’ve blacked out the boxes that shouldn’t change from one to another. (Note: the spreadsheet won’t allow you to make changes within Google Drive. You’ll have to download it if you want to play around with it – which I encourage you to do!)

You can start with the simple stuff – your age, how much you’re making. For some of the items you’ll have to use a best guess or do some research – how much will the MBA cost per year, how much will you spend per year on living expenses, how much will you require in loans, etc. Any numbers that you’re really unsure about can stay as they are in the template. The numbers that appear there are my best guesses about things like the percentage one might pay on student loans – 6.8% - and the time it might take to pay them off – 15 years. Keep them as they are, or change them if you find better information.

How do you know what you’ll be making when you finish B-school? You don’t. But you can make an educated guess based on the starting salaries in the field you’d like to go into. The more accurate your guesses, the more accurate your final result will be. The same goes for the amount you’d make after a No-Pay MBA. Admittedly, there isn’t yet any information about how the market will value a MOOC MBA, so it’s probably prudent to make a conservative guess about how much you can increase your salary after such a course of study.

Also, bear in mind the assumptions I’ve made when making this spreadsheet. I’ve assumed that if you are doing a traditional MBA, it will take you two years, and you won’t be working during that time. For a No-Pay MBA, I’ve assumed three years (during which you will continue working) and $500 per year of incidental expenses associated with your coursework.

The one item you might not recognize is the discount rate. Basically, the discount rate is a way of accounting for the amount by which money loses value from year to year. Many of our grandparents have regaled us with stories about how much more valuable money was when they were kids. “I could buy ten candies for a penny! A dollar was really worth something back then.” Your grandfather is right. In 1940, his dollar could have bought 1000 candies. If he’d held on to that same dollar until today, he could probably only get about 25 or 50 candies with it. The dollar would have declined in value. That phenomenon is explained by the discount rate, and it is a very important consideration when evaluating any investment. For the purposes of the spreadsheet, I’ve set the discount rate at 3%, but you can change that as you wish.

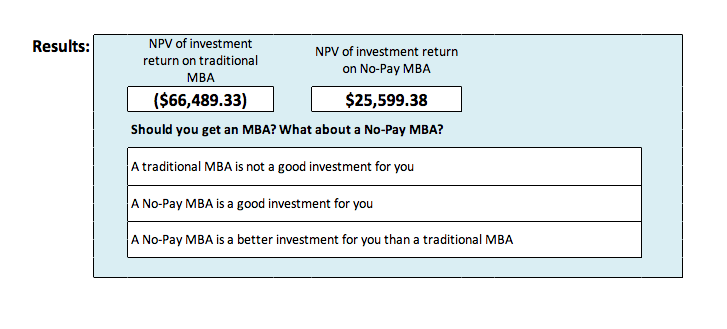

Once you’ve input all your information, scroll down to the bottom of the page. (The boxes that aren’t highlighted are there to do automatic calculations based on the data you entered, so don’t change them - unless, of course, you want to build a better calculator, in which case, be my guest!) At the bottom of the page you will see a box that looks like this:

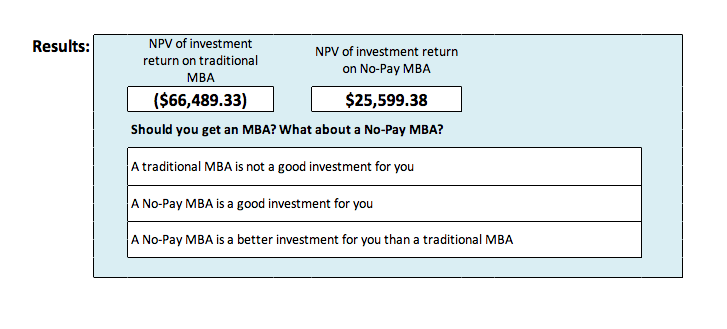

What this is showing is the net present value of your investment return for both the traditional MBA and the No-Pay MBA. The scenario in which you get no MBA at all is serving as a baseline. In order to be worth investing in, the MBA would have to result in you earning enough over the course of your lifetime to offset the cost of the MBA, the interest on your loans, and the lost earnings during the time you spend studying and not working. If you see a positive number in the box for “NPV of investment return,” the investment is a good one. The greater the number in that box, the better the investment. Why NPV, you ask? That stands for net present value, and it factors in the discount rate, as explained above.

As you can see, for the person I’ve invented here (perhaps not so different from me), the traditional MBA is not a good investment. The No-Pay MBA on the other hand, is.

by Laurie Pickard | Feb 15, 2014 | Courses, Platforms, and Profs

As I’ve mentioned previously, my goal in taking MBA courses is not to go into finance or consulting. Rather, I want to build skills that are relevant to the international development work I am already doing, and eventually to move from public sector development work to related work in the private sector. I am currently taking a course that is a great bridge between these two, aptly titled Subsistence Marketplaces.

Subsistence Marketplaces Professor Madhu Viswanathan

What I like about Subsistence Marketplaces is the difference in approach from previous courses I have taken on development, both in undergraduate and graduate school. This course looks at the markets that exist in places where much of people’s daily activity is about survival. It doesn’t ask why people are poor or analyze the interventions foreign governments have undertaken to help them; it doesn’t look at the history of poverty and development. Not that these more traditional approaches to studying poverty and development aren’t important, but it is refreshing to look at a subject I know well from a different angle.

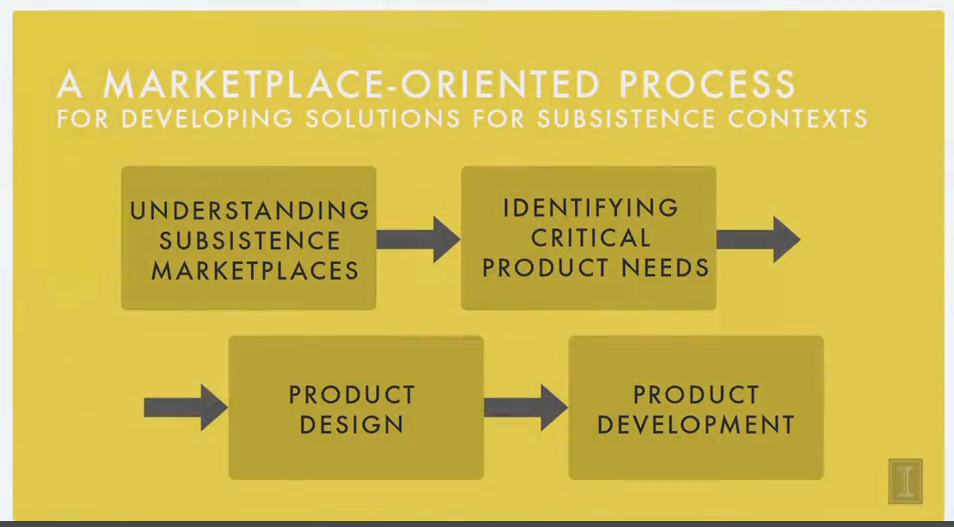

In Subsistence Marketplaces we are trying to get inside the minds of poor consumers, understand their lived experience, observe how they operate in the marketplace and from there, design products to serve their market. I’ve seen this type of analysis before – in How to Build a Startup, where I learned the importance of mapping out “A Day in the Life” of your intended customer. This exercise helps to identify the daily frustrations the consumer experiences and the types of innovation that could result in a marketable product. For consumers living in poverty, it helps to understand the reasons – and there is always a reason - for behaviors that may not at first make sense to an outsider. For example, why buy from a store that charges higher prices? (Answer: it’s run by a neighbor who gives credit.)

Our ultimate goal in this course is to come up with a product that could be marketed to the mass of poor people who constitute the base of the economic pyramid, otherwise known as the BOP. In recent years some interesting solutions for BOP consumers have gotten a lot of attention, for example M-Pesa (mobile phone-based banking for the poor) and microfinance (credit and savings for the poor).

Our ultimate goal in this course is to come up with a product that could be marketed to the mass of poor people who constitute the base of the economic pyramid, otherwise known as the BOP. In recent years some interesting solutions for BOP consumers have gotten a lot of attention, for example M-Pesa (mobile phone-based banking for the poor) and microfinance (credit and savings for the poor).

Coming up with a product for the BOP is easier said than done. As any Peace Corps volunteer can tell you, poor people are experts at navigating their environments, and just because a new way of doing things sounds like a good idea to you – organic gardening, say – doesn’t mean people will rush to adopt it once you’ve told them the good news. You may have overlooked the voracious leaf-cutter ants that flout any attempt short of noxious pesticides at controlling their apetites, or any number of other impediments to adopting a new technology. The same goes for any product or intervention aimed that the BOP market; business people and development professionals alike can benefit from a rigorous analysis of their product/intervention’s value proposition within the context of the lives of the people they are trying to serve.

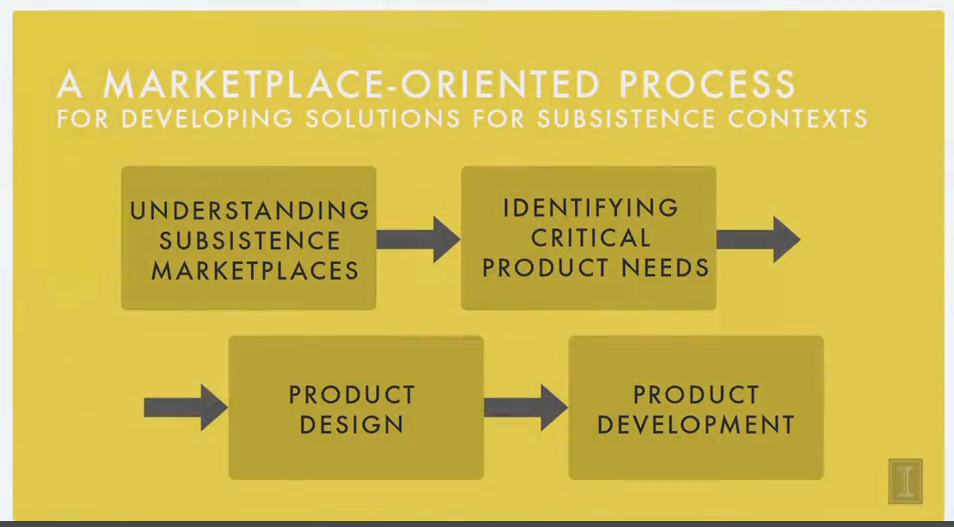

In product development, once you have developed an understanding of the lives of your customers, you move on to identify some of their most salient needs. From there, you pick a need that you think you can address with an innovative solution. Sounds simple enough, but it’s tough to come up with an innovation so useful that poor people will be willing to part with scarce money. I’m not sure if I’ll hit on anything brilliant by the time it’s due - so far, I haven’t managed to come up with anything that doesn’t already exist in the BOP market – but the assignment has got me scouting marketable solutions.

by Laurie Pickard | Feb 8, 2014 | Courses, Platforms, and Profs

I’ve started reviewing my courses on the website Poets and Quants. You can see the first one at: http://poetsandquants.com/2014/02/06/the-best-mooc-for-entrepreneurs/. I’ll be doing these reviews about once a month, so stay tuned for more!

by Laurie Pickard | Feb 2, 2014 | Community and Networking

Last week, I put out a call for others like myself who are using MOOCs to do the equivalent of a complete MBA. I received responses from all corners of the globe – from Boston to Dubai. Allow me to introduce four fascinating people who are taking advantage of free online resources to reach their educational and career goals.

Name: Brian

Name: Brian

Age: 27

Lives in: Boston, MA

“Currently, I work as a tax lawyer for an accounting firm in Boston. I am committed to completing a MOOC MBA because, after completing a BA in English (what do you do…), a J.D., and a Tax LL.M., I have some gaps in my financial and quantitative education. I would like to use MOOC courses to expand my knowledge, encourage my intellectual curiosity, and develop skills to add value to my firm’s clients. After finishing my MBA coursework, I hope to transition into higher-level management while maintaining a strong focus in tax and finance.”

Has completed the following coursework:

- Introduction to Finance

- Gamification

- Grow to Greatness: Smart Growth for Private Businesses, Part II

- Global Business of Sports

Currently enrolled in:

- The Power of Microeconomics

- The Power of Macroeconomics

- Foundations of Business Strategy

- Critical Perspectives of Management

- Grow to Greatness: Smart Growth for Private Businesses, Part I

“I think continued education and lifelong learning is the key to success in whatever you choose to do. Intellectual curiosity allows you to realize when to ask questions and what questions to ask. I would encourage everyone to use the structure from MOOCs to pursue one’s passions. For me, I am passionate about financial education, literacy, tax, finance, and educational reform. I hope to use my knowledge and experiences to support others who wish to create change through their own businesses and financial pursuits.”

Name: Kathy Hilsinger Walliser

Age: 62

Lives in: Greensboro, NC

“I am writing a PhD dissertation on Schistosomiasis, a neglected tropical parasitic disease. I have developed a range of preventatives. So, I needed to find out how to set up a corporation to make this and distribute it to the 700 million people at risk worldwide. Answer: open course MBA.”

Kathy’s goal is to eradicate Schistosomiasis from humankind, just as Smallpox and certain types of Polio have been eradicated.

Currently enrolled in:

- Introduction to Corporate Finance by Dr. Franklin Allen, The Wharton School.

“I tell people that NOW they can do it. There is a world of knowledge out there and with the courses, texts, lectures, and background reading, it can all come together. MANY subjects, languages, interests; there is something that they can pursue.”

Name: Penelope Perez

Name: Penelope Perez

Country of origin: Mexico

Lives in: Dubai, UAE

Penelope works as an account manager in the advertising industry. Her reason for doing a No-Pay MBA is,

“ to acquire the necessary tools to start my own business. I’m passionate about Social Innovation, so I would like to apply all the knowledge and experience to my own business and become an active agent of positive social change.”

Currently enrolled in:

- Foundations of Business Strategy (University of Virginia via Coursera)

- Critical Perspectives on Management (IE Business School of Madrid via Coursera)

“I’m really happy to have found accessible ways to get high quality education by MOOC. I’m happy and feel lucky to be part of this project (The No-Pay MBA), and I realize there are plenty of people determined to continue learning, each for different reasons. The most important thing is that people see beyond the economic/time restrictions and try their best to accomplish their goals.”

Name: Greg Widders

Name: Greg Widders

Age: 23

Country of origin: Australia

Lives in: Sydney, Australia

Greg works as a Digital Marketing Coordinator for a large windows and doors manufacturer across Australia and parts of Asia.

“Going through University completing a Bachelor’s degree in Industrial Design I felt completely flat about learning. I wanted to get out, get a job, work during work hours and then go home and just do nothing! Not a year into work, I’ve taken a sidestep into marketing and I have secured my first promotion to a position where I am learning on the job. I have been completely reinvigorated! I work longer than I need to, and then when I get home I find myself searching tutorials to help me at work or develop another skill further. I want to complete a MOOC MBA because it gives direction to this drive. I also want the flexibility to change my study load at the drop of a hat without consequence. I’m at a point in my life where some interesting things are on the horizon and I feel locking myself into the structure of a full MBA is not right for me at this moment in time. Another point is that more and more I’m discovering it’s not the degree that impresses bosses, it’s a demonstration of a willingness to learn. Image going into a job interview and saying, ‘I completed my bachelor’s degree and then over the next two/three years I completed the equivalent of an MBA through online courses from the likes of Wharton, Yale, Harvard while working full time.’ I think that shows a willingness to learn.”

Currently enrolled in (all from Coursera):

- Foundations of Business Strategy

- Developing Innovative Ideas for New Companies: The First Step in Entrepreneurship

- Introduction to Finance