I’ve written a lot about why I think I a MOOC-based MBA is a good idea for me. I already have a master’s degree, I live in a place where B-school isn’t readily accessible, I already work in the field I want to be in, I am building my network through professional contacts in my field, etc. But I realize that I haven’t made the financial case for the No-Pay MBA. I would like to take this opportunity to fix that.

One of my themes this semester is finance, so it’s a good time to take a look at the financials for the No-Pay MBA. I have created a spreadsheet – what else do you do in finance? – to help me (and others) figure out how an investment in a No-Pay MBA stacks up next to an investment in a traditional MBA. I am making this spreadsheet available as a tool that anyone can use.

The spreadsheet can be found here: No-Pay MBA v. Traditional MBA Calculator

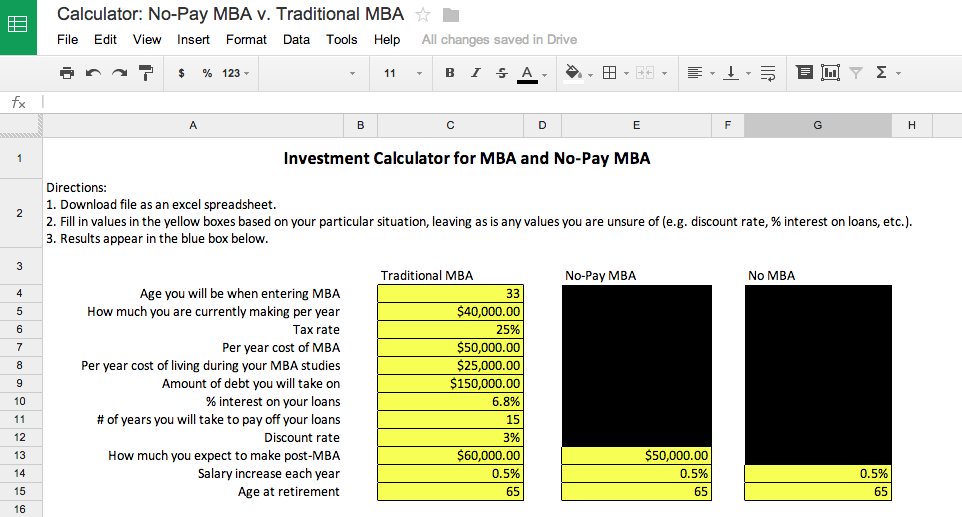

It looks like this:

For those who haven’t studied finance, let me explain how it works. In order to answer a question like “is an MBA a good investment?” you have to define the situation in which you will be investing in an MBA - are you a recent college grad with 30 years of work ahead of you, looking to go into a career in finance; or are you in your mid-thirties, working in non-profit administration, trying to get a leg up for your next position? These factors make a difference as to whether an MBA is a good choice for you or not. In the spreadsheet, the yellow boxes allow you to fill in details that reflect the particulars of your life and career situation. The spreadsheet has columns for three scenarios – traditional MBA, No-Pay MBA, and no MBA. I’ve blacked out the boxes that shouldn’t change from one to another. (Note: the spreadsheet won’t allow you to make changes within Google Drive. You’ll have to download it if you want to play around with it – which I encourage you to do!)

You can start with the simple stuff – your age, how much you’re making. For some of the items you’ll have to use a best guess or do some research – how much will the MBA cost per year, how much will you spend per year on living expenses, how much will you require in loans, etc. Any numbers that you’re really unsure about can stay as they are in the template. The numbers that appear there are my best guesses about things like the percentage one might pay on student loans – 6.8% - and the time it might take to pay them off – 15 years. Keep them as they are, or change them if you find better information.

How do you know what you’ll be making when you finish B-school? You don’t. But you can make an educated guess based on the starting salaries in the field you’d like to go into. The more accurate your guesses, the more accurate your final result will be. The same goes for the amount you’d make after a No-Pay MBA. Admittedly, there isn’t yet any information about how the market will value a MOOC MBA, so it’s probably prudent to make a conservative guess about how much you can increase your salary after such a course of study.

Also, bear in mind the assumptions I’ve made when making this spreadsheet. I’ve assumed that if you are doing a traditional MBA, it will take you two years, and you won’t be working during that time. For a No-Pay MBA, I’ve assumed three years (during which you will continue working) and $500 per year of incidental expenses associated with your coursework.

The one item you might not recognize is the discount rate. Basically, the discount rate is a way of accounting for the amount by which money loses value from year to year. Many of our grandparents have regaled us with stories about how much more valuable money was when they were kids. “I could buy ten candies for a penny! A dollar was really worth something back then.” Your grandfather is right. In 1940, his dollar could have bought 1000 candies. If he’d held on to that same dollar until today, he could probably only get about 25 or 50 candies with it. The dollar would have declined in value. That phenomenon is explained by the discount rate, and it is a very important consideration when evaluating any investment. For the purposes of the spreadsheet, I’ve set the discount rate at 3%, but you can change that as you wish.

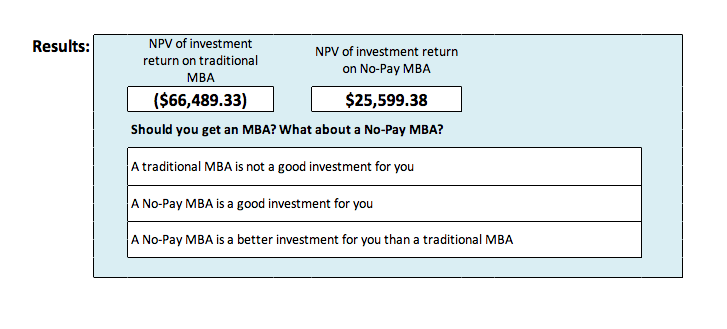

Once you’ve input all your information, scroll down to the bottom of the page. (The boxes that aren’t highlighted are there to do automatic calculations based on the data you entered, so don’t change them - unless, of course, you want to build a better calculator, in which case, be my guest!) At the bottom of the page you will see a box that looks like this:

What this is showing is the net present value of your investment return for both the traditional MBA and the No-Pay MBA. The scenario in which you get no MBA at all is serving as a baseline. In order to be worth investing in, the MBA would have to result in you earning enough over the course of your lifetime to offset the cost of the MBA, the interest on your loans, and the lost earnings during the time you spend studying and not working. If you see a positive number in the box for “NPV of investment return,” the investment is a good one. The greater the number in that box, the better the investment. Why NPV, you ask? That stands for net present value, and it factors in the discount rate, as explained above.

As you can see, for the person I’ve invented here (perhaps not so different from me), the traditional MBA is not a good investment. The No-Pay MBA on the other hand, is.